Report Summary

Period covered: October 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Subscribe to access this data or take out a free 30-day subscription trial now.

Inflation

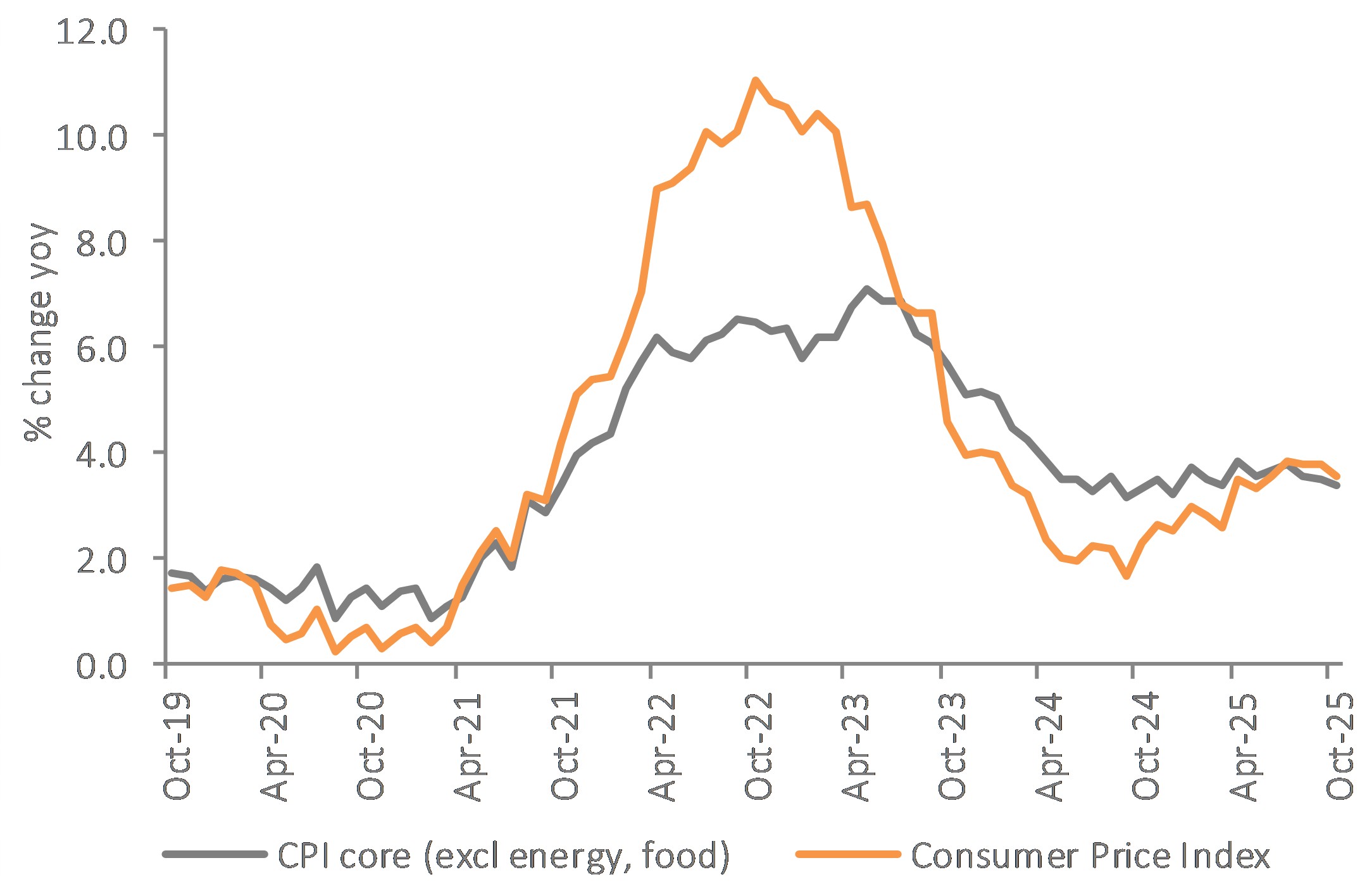

Headline inflation eases: CPI inflation slipped to xx% in October, down from xx% in September. The monthly rise of xx% was smaller than a year ago, indicating the pace of price increases is cooling but not yet fast enough for a clean break in momentum. Housing and energy costs delivered the clearest downward pull, helped by Ofgem’s latest price cap adjustment.

Lower services inflation: Goods inflation slowed to xx%, while services inflation eased to xx%, its weakest reading since the spring. The moderation was helped by gentler increases in accommodation costs and a flattening in parts of transport and housing linked services.

Transport costs stable: Transport inflation held at xx%. Air fares rose only xx% on the month compared with last year’s xx% increase, easing pressure on the annual rate. Petrol and diesel prices ticked up, pushing motor fuel inflation into positive territory for the first time since early summer. Vehicle maintenance also added upward pressure.

Food inflation rises again: Food and non-alcoholic beverage inflation rose to xx%, from xx%, reversing September’s brief easing. Prices climbed xx% on the month, with bread, cereals, vegetables, fish and confectionery all moving higher.

Costs backdrop: Input cost pressures remain firm. Producer input prices rose xx% year-on-year in October, while output prices climbed xx%, suggesting manufacturers are still passing higher costs through supply chains. Commodity benchmarks remain elevated, and shipping rates continue to climb, keeping import and distribution costs tight. Oil prices have eased but remain too high to offer meaningful relief to transport-heavy categories. Together, these factors continue to weigh on inflation.

Financial market reaction: Markets have strengthened expectations of a December rate cut, with the probability now near xx% following October’s softer inflation figures. Yields have edged lower, and sterling has steadied as investors position for the Bank of England to begin easing provided next week’s Budget confirms the expected fiscal tightening for 2026.

Inflation outlook: October’s data shows a clearer turn in momentum. Housing and energy costs are easing at a faster pace, taking some of the heat out of the index after a long stretch of strain. Food inflation moved higher again this month, yet producer trends point to this rise being close to its limit.

Rent growth is slowing and private-sector wage pressures are fading, which supports the idea that services inflation is gradually losing strength. The Bank has already indicated that the peak is behind us, and the inflation data supports that message. With CPI now below September’s level and several earlier projections beaten, markets have swung firmly towards a December cut.

For households, the data feels calmer, with energy bills rising less sharply, transport costs settling, and day-to-day services no longer shifting as abruptly. Inflation still weighs on budgets, but the sense of volatility is easing, which matters for confidence heading into winter.

Take out a free 30-day trial subscription to read the full report >

CPI inflation slipped to 3.6% in October, down from 3.8% in September.

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis